Few traders stop to consider the context that determines the Forex market, although it would be all. Since the Forex market is increasingly playing the role of retail investment environment, you need as much detail as possible to explore all the nuances of the environment and the rules that will survive and successfully operate in the investment environment.

Analysis• Who: to know the Forex market actors that shape the markets;

• Why: to understand the nature of forex market and its attendant opportunities;

• Where: Find the best dealer, is suited to your goals;

• What: choose a shopping tool, based on your preferences;

• When: To determine the time when the transaction would be most effective;

• How to: pick up a set of analytical tools that really improve your trading.

Action• Draw up a personal trading plan;

• Find solutions that will help you execute your trading plan, step by step.

AnalysisFor most traders, a comprehensive trading plan is a false ideal. In particular, in the FOREX market the illusion of easy money often distracts the trader from the reality, which is a difficult and painstaking work. But how can attest to anyone who has achieved success in trade, commerce - so, above all, discipline. Trading requires a plan based on extensive market knowledge and ability to carefully and consistently apply this knowledge. The main component of any trading plan - an understanding of context, which defines the surrounding market environment.

Six of the market ForexMovement of prices in the FOREX market to resemble traffic shoal of fish. At one point - an absolute harmony, the next - a complete chaos. As an observer of these jambs of fish, you believe that you can accurately predict the direction in which it cannot go every time? Are you ready to bet on this?

What makes the fish go that way rather than another? Why do they operate together in an instant, moving with force and precision, and move in such a way that seems to be an infinite number of directions? There is no way to know if you can not feel that sense of fish every time they move. Pisces have an instinct as to the nature of their environment. They are born to understand the context of all the things around them, and can react accordingly. Of course, if you have such an understanding, you would have been far more accurate predictor of the movement of fish! Trading on the Forex market in this sense is not very different - we must develop a sharp sense of what is happening around us. Can we ever accurately predict every move in the FOREX market? Of course not. But we can use our understanding of the context of the market - the six forces of forex - to make better, more cost-effective choice of deals. Once we understand these forces, we can build and work within the framework of a comprehensive trading plan:

• Who sells at Forex? You must know who is participating in this market, why are they successful and how you can emulate them.

• Why trade Forex? It is possible to obtain excellent income trading at Forex, but not for all participants. You are one of them?

• Where you need to sell? Select service providers that can provide you with the opportunity to effectively sell your style.

• What you need to sell? Select a currency pair, methods of entry, exit and management of money, which maximize your income.

• When you need to sell? Deal, when the market environment is most likely to provide the best conditions in order to sell on your system.

• How should you trade? Deal, using the methods that have proven their ability to provide maximum efficiency.

Knowledge of these forces and how they work, is the main component of your success as a trader. Figure 1 shows these 6 forces, their relative rarity, and their impact on profitability.

The lower you are moving to this scheme, the less you will find traders who understand an element of the overall context and the more revenue you can achieve with the trade.

WhoFar more important than knowing who trades in Forex, know who trades in Forex successfully and how they do it. Players in the Forex market work with widely varying horizons. When one of these players are in the market, the impact is proportional to force the trade initiator. This effect may play a role in the short term, a radical change in prices, and could play a long-term role in determining trends. Figure 2 shows the main participants in the market Forex.

Each group of participants has a different attitude, goal, investment horizon and market impact. A key difference among these market participants is their level of sophistication, which is determined by the following elements:

• Managing money

• Aims to Profit

• Level of automation

• Quantitative ability

• The ability to study

• Level of Discipline

Of course, there are sophisticated and inexperienced banks, governments, corporations, investment funds and traders. But among these segments, the individual trader has the lowest level of external control. Taking into account that the government, banks, corporations and investment funds follow the instructions and limitations (to some extent), traders are only limited by the level of their capital.

In the absence of external constraints, traders are divided into two groups: those who can impose internal constraints, ie discipline to their trading strategy, and those who can not. Those who can impose this discipline, we call the experienced trader. In a zero-sum game of trading in the FOREX market, the trader uses the hard tools and strategies that mimic instruments have a very sophisticated institutional participants to extract profits from the party, a newbie. Only hard-trader is able to achieve positive results in the FOREX market.

WhyThe volume of trades in the FOREX market in recent years has increased, as more and more individual traders to earn a living, selling it, and the popularity of riskier investment vehicles like hedge funds, has increased. The main incentive for these investors is the higher yield, but on the foreign exchange market, four major factors create a unique investment environment:

o Liquidity

o Leverage

o Convenience

o Cost

In any other market you can not find the conditions that are favorable to the investor, at least at first glance. However, using their advantage of these favorable factors, you should always keep in mind on their back side.

LiquidityThe liquidity of the market have a high degree of transparency, even when large transactions occur. Worldly-wise trader understands that it means: the Forex market involves very large players. Because traders are growing in their sophistication, they understand that these big players have a significant impact on the price, and monitor their entry into the market.

LeverageThe low margin requirements in the FOREX market allows to obtain the correct analysis of huge profits. However, in the case of an incorrect analysis, the multiplier effect of leverage also increases the loss.

The worst scenario - a series of consecutive losses. Knowing how many consecutive losses your system can afford is a key factor for the preservation of capital. (left - the number of consecutive losses, the top - the lever, right - the remaining percentage of capital)

AccessibilityThe fact that you need to go to sleep or spend time with his family, does not stop the functioning of the market Forex. In other markets you can trade during certain hours, usually from 6 to 10 hours, which are clearly defined. On the other hand, trade on the forex market requires a 24-hour monitoring. This can be achieved through the automated trading system or, less optimally, through a defined stop-order and limitordera or physical control of the transaction.

Price"No fees" - a marketing slogan, many dealers, that is perceived as a significant profit. But the fact that there are no commissions, does not alter the high transaction costs, spreads paid to dealers through the purchase / sale. There is no doubt that liquidity, leverage, comfort and operating costs available in the FOREX market are excellent tools for investors, but not always. As easily as these tools can be used to create capital, they may be using the wrong lead to the destruction of capital. Beginner traders destroy capital, and its sophisticated pose.

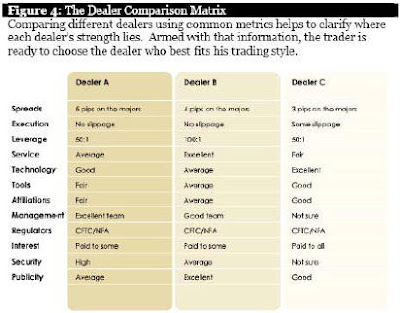

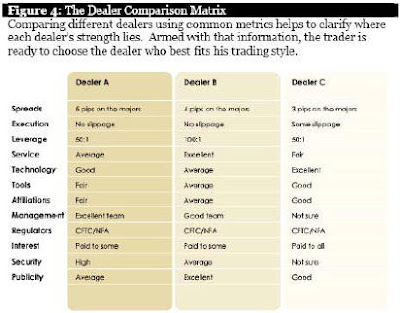

WhereOne thing is to choose a dealer, and quite another - to choose the right dealer. Offers service dealers can take many forms, and each dealer usually has one or two major features that they bring to the fore. In the analysis of the dealers, you understand and appreciate all of their proposals for the service, and then apply it to your style of trading that pick for themselves the best dealer.

Understanding the basic components of the trade plan was crucial for successful trade. All these factors work together. Trade currency pair with a wide spread, using a short-term signals the entrance and a great arm, probably will not be the most successful strategy. On the contrary, trading foreign currency pair with a narrow spread, using medium-and long-term signals to the entrance with a small lever, has a greater chance of success.

In the final analysis, currency pair, the signals and the approaches to the management of money should be combined, and without controversy. Beginner traders make critical mistakes, trying to hide together strategies from different sources, instead of systematically constructing, testing and building a comprehensive plan of trade. Hard-trader, which makes this a difficult job, working with the trade, which creates opportunities for consistent profits.

WhenForex market operates 24 hours a day, but whether the market activity of the same all the time? Of course not, but many traders do not take into account this fact in their work. By studying historical price data, you can compile the following tables of market activity.

It is better to sell at the most opportune time. The table presents the average trading ranges for the four major currency pairs. One of the best ways to confirm the technical indicator - this amount. When strong, the indicators tend to be more accurate. Unfortunately, no data on the amount available for the Forex market. Use of trade ranges - following an effective tool. With these data at hand, traders can more carefully evaluate when to trade. Not only the technical indicators will generally be more accurate at different moments of the day, but there is a potential for greater profits, and the potential for lower losses at other times of the day. Consider trade on the EURUSD at 10.00 EST against trade 22:00 EST. In the first case, the average trading range is 30 points in the second - 10 points. Entrance to the market during morning trading creates some interesting opportunities - the market can go with you or against you, but you should be ready to move in any case. On the other hand, if the market goes against you by 10 points in 22:00, as far as you concern? Probably not as good as if it was 04.00.

Anyone can trade based on technical indicators. Beginner trader, in particular, ignores the importance of "when" to trade. Worldly-wise trader uses timing to their advantage, creating opportunities for profits and limit losses.

As

AsOnce an understanding of the external trade is over, the hard work begins: the trader must understand their own consciousness. External items are easy - they are usually rational, evidence-based, consistent and streamlined. However, the trader's mind away from all this. Trader goes through a huge number of emotions and thoughts during the trading. Some of them have a negative impact, some positive, but very rarely see a trader, who would be consistently followed his trading plan.

Emotions, or lack of discipline are the biggest enemy of every trader. This is so true, that could be argued that the discipline is a more valuable asset than the very commercial capital, because capital can be supported only with discipline. We can not say that a trader can bring some value - it does. In moments of clear, objective examination, many traders, even novices can build excellent trading system. These systems can benefit their understanding of the market Forex. However, once live, the system suddenly dilapidate.

Why?The simple reason is that emotions should not be present in the trade. Emotions compel the trader to act differently after big wins or losses. Emotions compel the trader to act is absurd when there are large movements. Emotions compel a trader to apply his trading system inconsistently. If you've done a review of successful traders, you would find many similarities. Traders understand and apply all the forces of the market Forex. They are usually traded in an incredibly simple trading systems. They use a conservative, well-thought-out philosophy of managing money, and they trade with absolute consistency. For the institutional investor, absolute consistency is not a problem because they have more staff and more resources at their disposal. For individual traders, there are three groups. Those who trades with consistency, those who traded with the manual sequence and those trading with an automated sequence. Beginners, of course, are traders who benefit from the transaction to the transaction. An individual trader who uses a consistent discipline or automation as the basis for its trading activities, maximizing their level of sophistication.

ActionWorldly-wise trader understands market forces six Forex. He works with the understanding the market environment, and this understanding lies in its commercial run. To succeed in trading on the FOREX market, you must become a skilled trader.